Table of Content

Cash flow can quickly exit of hand if you have enormous overhead bills. Retail businesses can barely get well if additionally they pay loans with increasing rates of interest. Hence, a service provider cash advance is a wonderful alternative to traditional enterprise loans.

It’s difficult for business homeowners with unhealthy personal credit or a thin business credit score profile to get a small business loan, and even more difficult for newer enterprise homeowners. Can Capital helps bridge that gap, permitting businesses with $4,500 in monthly bank card sales and 6 months in enterprise to qualify. Be warned, however, their reimbursement phrases are short and better issue rates lead to the next APR than normal. A merchant cash advance isn't as challenging to qualify for as different small enterprise mortgage choices.

Merchant Cash Advance For Enterprise Instance

For instance, when you have excessive bank card gross sales one week, you’ll pay the advance sooner. The flexibility of cash advances works properly for companies with seasonal highs and lows. While working to pay back your merchant cash advance, there might be a every day quantity you must hold again from your bank card transactions. Before getting a merchant money advance, you need to look over your gross sales and see how viable this shall be in the course of the payback interval. Lastly, there’s no profit to paying off the whole advance early. Unlike a more traditional financing possibility, your repayment quantity would be the identical, regardless of when you pay off the advance.

As lengthy as you process your gross sales by way of card transactions and gross sales are constant, you may have a90% chanceof approval. Frequency – depending on the cash supplier, the payments could be set on a every day or weekly basis, so be certain to examine it earlier than signing the papers. The best choice is monthly installments, as it’s much less restrictive. Now, the reimbursement of this advance usually happens primarily based on the sales that are registered on the point of sales terminal. This signifies that the financial institution has entry to the bank account the place the proceeds of sales are deposited. The financial institution is also authorized to make deductions from these accounts primarily based on the settlement.

Journey Safe Throughout Covid-19

Whether it’s Google adverts or building a social media presence, use cash out of your MCA to assist your advertising efforts. Once you determine an MCA is right for you, discover a provider who will give you the most effective deal. If you've a Shopify store and use Shopify Payments, you probably can verify your eligibility with Shopify Capital.

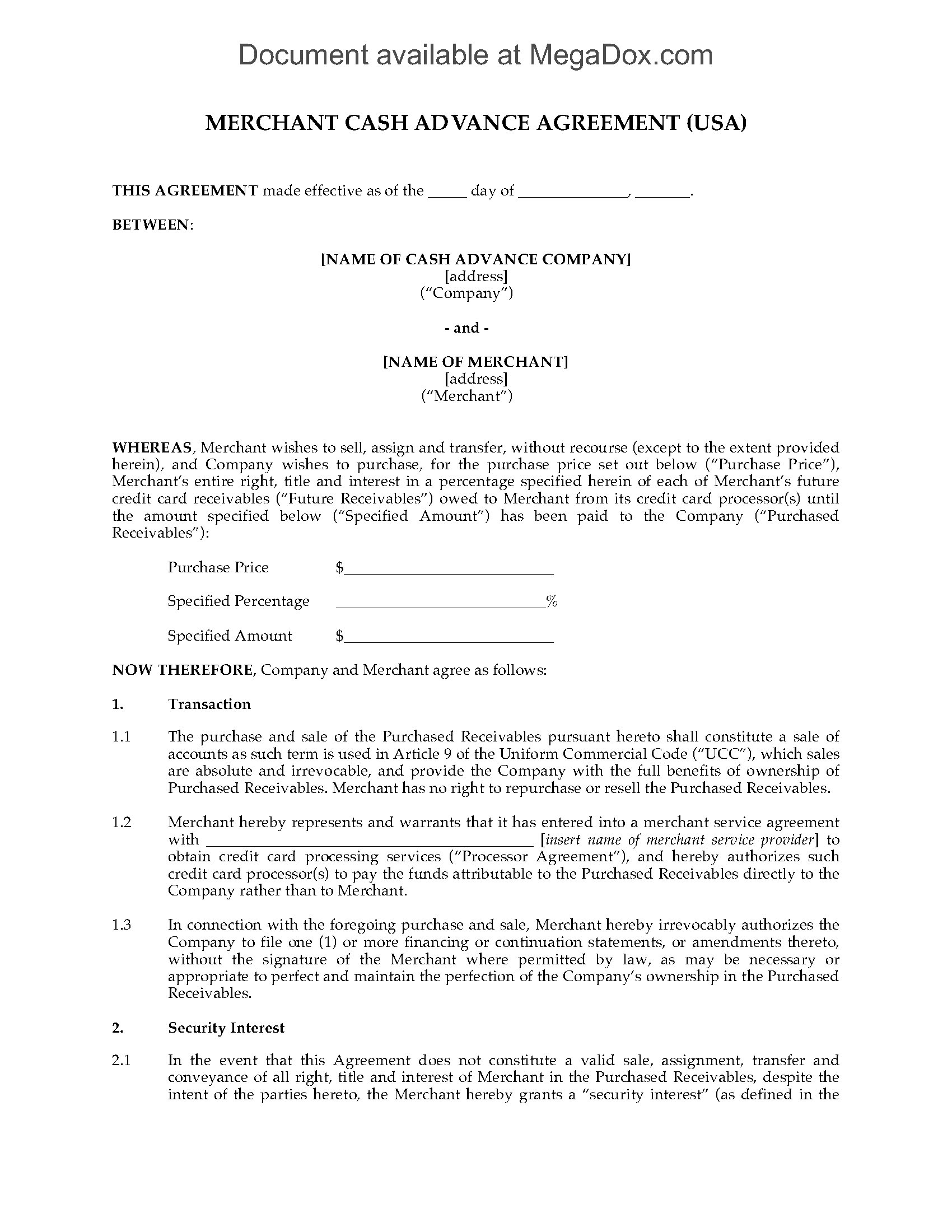

These service provider cash advances usually are not loans – somewhat, they're a sale of a portion of future credit and/or debit card gross sales. Therefore, merchant cash advance transactions usually are not topic to state usury legal guidelines that limit lenders from charging high-interest rates. Critics argue that, as a consequence, they operate in a largely unregulated market and charge much greater rates than banks. You’re truly selling a share of these bank card and debit card gross sales to the merchant cash advance provider.

If the business chooses to repay the advance with a set remittance, mounted every day withdrawals will automatically be faraway from the account. Automated Clearing House withdrawals include automatic withdrawals from your gross sales to your money advance provider. Depending on your agreement, repayments could additionally be mounted or variable quantity. However, if you are experiencing a decline in revenue, your lender may be keen to adjust a set reimbursement amount.

Obtaining a merchant money advance is not a tough nor tedious enterprise. Compared to different lending industries, the service provider money advance business isn't closely regulated. Since money advances are not legally considered loans, lenders usually are not subject to the same regulatory oversight with which different lenders should comply. A holdback is the dollar quantity of every day sales your lender retains and applies to your advance. This dollar amount is a share you agree upon when setting your MCA phrases.

If you fall underneath this category and have held a American Expressbusiness credit score cardfor over a year, this might be a much cheaper alternative to a merchant advance. A merchant cash advance is a faster various to traditional small enterprise loans that can unlock cash towards your business’s future income. It is most often used for obtaining funding with out the prolonged process and requirements of more traditional small enterprise loans. If your payments are variable, the provider will obtain a copy of your bank card assertion and deduct a proportion of your income.

The rating of this firm or service is based on the author’s professional opinion and analysis of the product, and assessed and seconded by another subject material skilled on staff before publication. Merchant Maverick’s scores are not influenced by affiliate partnerships. Typically MCA fees vary wherever from 1.09 to 1.6 (or 9% – 60% of the borrowing amount), however you might be succesful of discover fees which might be larger or lower. The supplier may require other charges, similar to an origination charge or closing fee, along with the factoring fee. Ella Ames is a contract writer and editor with a concentrate on private finance and small business matters such startups, business financing, and entrepreneurship. She has a background in business journalism and her work has appeared not solely on The Balance, however LendingTree, ValuePenguin, EE Times, PolicyMe, AllBusiness.com, and extra.

As the name suggests, the business financial institution offers a service provider i.e. borrowing corporation with an advance. The commercial banking system has undergone a high deal of innovation prior to now few years. A lot of new business lending merchandise have been introduced so as to assist business handle their finances better.

Also,dangerous creditis far from the only purpose to hunt a business money advance. Since this product isn't categorized as a “loan,” it doesn't show up as “debt” or a “liability” on your steadiness sheet. If you already have too many liabilities, including one other could harm your corporation credit score scores and make it tough to acquire trade credit from distributors.

No comments:

Post a Comment